A Southampton investment adviser who squandered his clients’ funds on luxury items, including a membership at an exclusive Hamptons country club, has been convicted of wire fraud, investment adviser fraud, and money laundering.

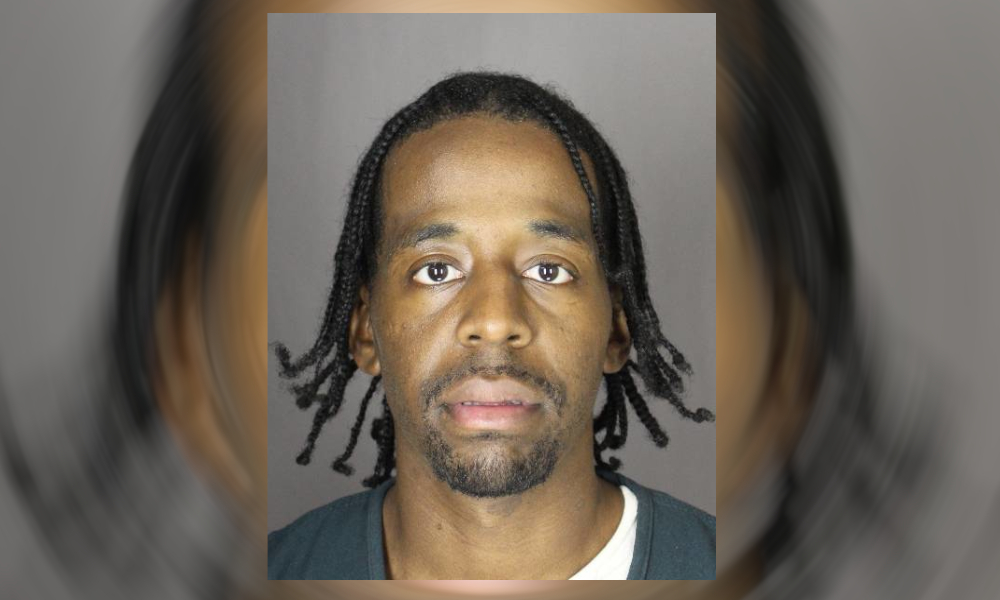

Jeffrey Slothower, 54, former founder of the New York investment advisory firm Battery Private, Inc., was found guilty by a federal jury in Central Islip today. Slothower’s fraudulent activities, which involved misappropriating more than $1 million from his clients, led to his conviction on all three counts of the indictment. When sentenced, Slothower faces up to 30 years in prison.

The conviction followed a three-day trial. The announcement was made by Breon Peace, United States Attorney for the Eastern District of New York, and James Smith, Assistant Director-in-Charge of the FBI’s New York Field Office.

“This case was about greed and betrayal of clients who trusted the defendant and thought their money was safely invested with him,” said Peace. “Slothower tricked those clients so he could steal their money and lavish himself with a new car, high-end clothing and jewelry, and a membership at an East End country club.”

Slothower’s scheme began in 2017 when he solicited business from a California couple, Victim-1 and Victim-2, whose money he had previously managed at another financial services firm. Promising them returns without market risk, Slothower convinced them to invest in bonds purportedly backed by homeowner’s association fees, offering an eight percent return.

Between January 25 and January 27, 2017, Victim-1 sent over $500,000 to Slothower at Battery Private for investment in these so-called HOA Bonds. Instead of making the investment or holding the funds in “capital reserves” as claimed, Slothower diverted the money into his personal accounts, using it to buy a $125,000 Mercedes Benz SUV and pay membership dues at Long Island National Golf Club. To maintain the facade, Slothower made false quarterly payments to Victim-1, claiming they were investment distributions.

The fraud expanded when Victim-1’s spouse, Victim-2, also invested more than $500,000 in December 2017. As with the first investment, the funds were misappropriated for personal luxuries, including a $6,500 Chanel purse, a $13,000 Rolex watch, and over $11,000 in Ralph Lauren clothing. Slothower continued to deceive the victims with fake quarterly distributions.

In June 2018, Victim-1, still unaware of the fraud, invested an additional $84,000 into the fictitious bonds. This money was similarly used for purported quarterly payments and further personal expenses, including golf club dues.

Slothower’s sentencing is pending, where he could face a lengthy prison term for his crimes.