Two Suffolk County businessmen have been sentenced for orchestrating a tax fraud scheme that siphoned over $1 million from New York State. The schemes in two separate cases involved Brian Soltan, 62, of West Islip, and Gerald McCrystal, 51, of Dix Hills, who operated auto body shops and furniture stores respectively.

According to Suffolk County District Attorney Ray Tierney, Soltan, owner of several East Islip auto body businesses, and McCrystal, owner of Farmingdale-based furniture stores, both pleaded guilty to grand larceny charges for stealing sales tax money by fraudulently underreporting taxable sales on dozens of returns over several years.

Soltan, who ran businesses including Long Island Auto Body, Inc. and High End Collision, Inc., admitted to failing to report approximately $2,817,951 in taxable sales from January 2011 to November 2015, resulting in $244,799 in stolen sales taxes. McCrystal, operating under business names such as Levetz, Inc. and Roma New York, Inc., admitted to failing to report $8,979,157 in taxable sales between February 2008 to November 2015, resulting in $744,865 in stolen sales taxes.

On September 18, 2019, Soltan pleaded guilty to Grand Larceny in the Third Degree, a Class D felony, and was required to pay $250,000 in restitution prior to his sentencing on June 26, 2024. He was represented by Robert Macedonio, Esq. McCrystal, who pleaded guilty to Grand Larceny in the Fourth Degree, a Class E felony, on June 26, 2024, was sentenced immediately thereafter and was required to pay $745,000 in restitution.

“The deliberate theft of tax dollars is a serious offense that undermines the integrity of our tax system and places an unfair burden on law-abiding citizens and businesses,” said Tierney. “These cases serve as clear reminders that tax fraud will not be tolerated, and those who attempt to cheat the system will be held accountable for their actions.”

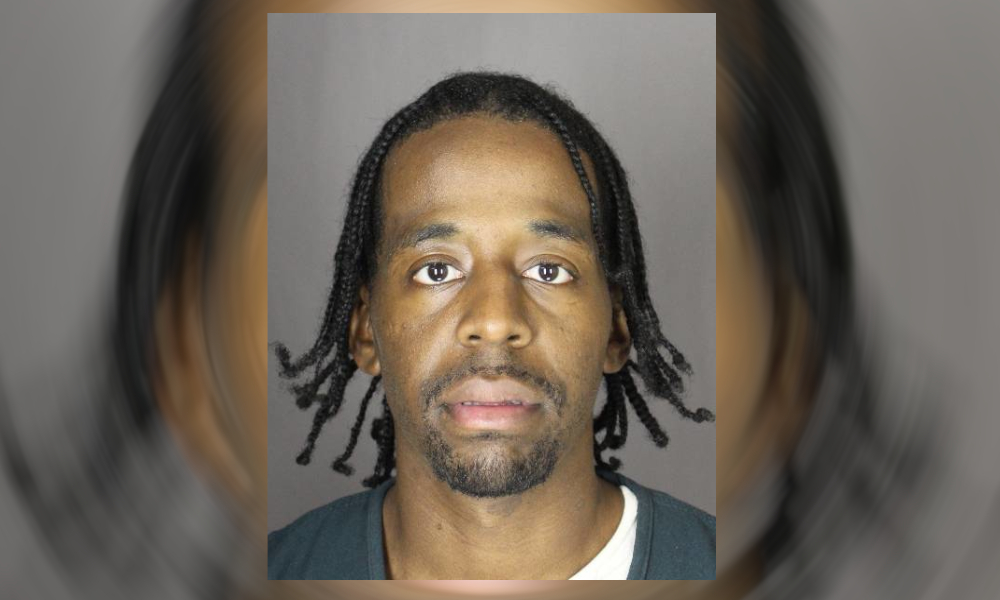

Brian Soltan (left) and Gerald McCrystal (right). Photo: SCDA.